10 Ways To Save For Your Next Vacation

10 Ways To Save For Your Next Vacation

Planning your next vacation can be exciting, but figuring out how to finance it can be a bit tricky. Here’s a straightforward guide with 10 practical tips to help you save up for that dream getaway. These tips are easy to follow and will help you manage your finances effectively so you can hit your savings goals without much stress.

1. Set Up a Separate Savings Account

One effective way to save is by setting up a separate savings account specifically for your vacation fund. you can often do this straight from your phone. Establish a standing order so that a portion of your income is automatically transferred to this account each time you get paid. This method ensures that some of your money is saved before you have the chance to spend it on other things.

2. Anticipate Flight Price Increases with Hopper

Flight prices can vary greatly, and using an app like Hopper can help you monitor these changes to find the best deal. Hopper predicts price trends and notifies you when it’s the cheapest time to book your flights. This tool can be incredibly helpful in managing your travel budget efficiently.

3. Save Money on Groceries

Groceries are a significant part of monthly expenses but also an area where you can easily cut costs. Consider swapping out some ingredients for less expensive alternatives, choosing cheaper brands, or cooking at home more often instead of buying prepped meals. These small changes can add up to big savings over time.

4. Use Cash Back and Rewards

When shopping, especially online, look for opportunities to earn cash back and rewards. Many credit cards and apps offer a percentage of your spending back when you purchase certain items or shop at specific stores. This is a simple way to save extra money just by continuing your regular spending habits.

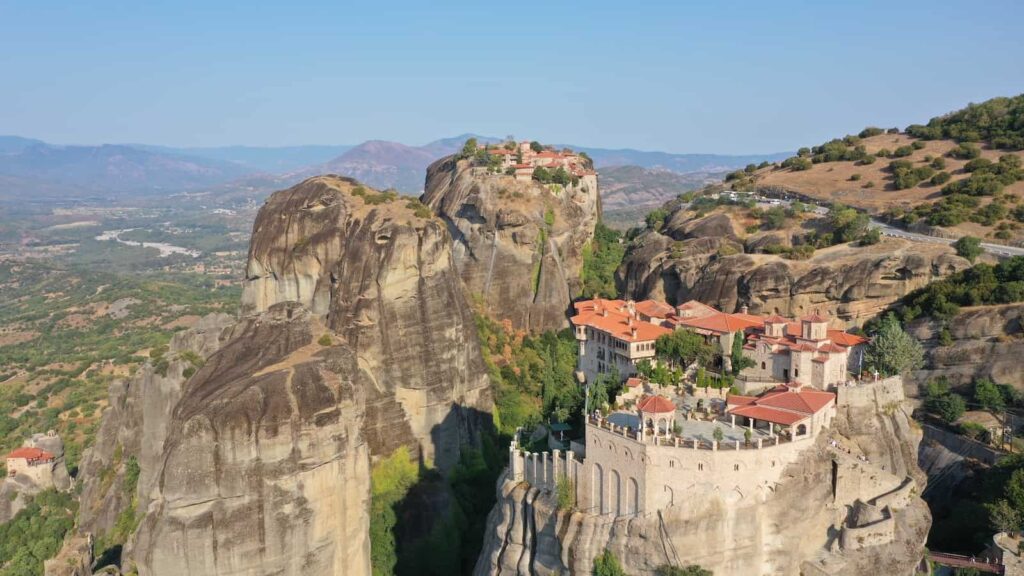

5. Travel During Shoulder Season

Traveling during the shoulder season — the period between peak and off-peak seasons — can be a cost-effective way to plan your vacation. During these times, prices for flights and accommodations are usually lower, and the weather is still pleasant, making it a win-win situation.

6. Bring Friends or Family and Split the Bills

Traveling with friends or family not only makes for a fun trip but also helps with finances. You can split costs like hotel rooms, car rentals, and even meals. This can significantly reduce the amount each person has to spend, making your vacation more affordable.

7. Ask Locals for Advice

Locals know their area best. Asking them for advice can help you avoid tourist traps and overpriced attractions. They can recommend where to eat, what to see, and activities that are worth your money. This insight can help you make smarter choices and save money during your travels.

8. Use the 30-Day Rule

The 30-day rule is a great way to curb impulsive spending. If you see something you want to buy, wait 30 days before making the purchase. If you still think it’s necessary after a month, go ahead. Often, you’ll find that the urge to buy has passed, allowing you to save that money for your vacation instead.

9. Only Use Cash for Spending

Using cash for everyday expenses can make you more mindful of your spending. Unlike swiping cards, handling physical money gives a real sense of how much you’re spending. This can encourage you to think twice about purchases, helping you save more in the long run.

10. Use Cards Only If They Offer Travel Rewards

If you’re going to use a credit card, choose one that offers travel rewards such as airline miles or hotel points. These rewards can be used to offset some of your travel costs. Just be sure to pay off the balance each month to avoid interest charges that could negate any benefits.

Inflation: 20 Ways To Save Money Easily

Read More: Inflation: 20 Ways To Save Money Easily

How A Week Of Planning Can Halve Your Grocery Bills According To An Expert

Read More: How A Week Of Planning Can Halve Your Grocery Bills According To An Expert

We are Mary and Eric, the founders of Be Right Back, a blog dedicated to romance around the globe and at home.

We are Mary and Eric, the founders of Be Right Back, a blog dedicated to romance around the globe and at home. With over 10 years of experience in dating and traveling to romantic places, we share our favorite date ideas and romantic destinations to help couples level up their relationships. Having lived in and traveled through the USA, we also share our favourite things to do in the States.

With 70,000 monthly readers and 16,000 followers on social media, Be Right Back is your go-to resource for romantic trip ideas and couple activities at home and abroad.